US Auto Insurance: 5 Key Factors to Choose the Best Insurance Company

In the United States, car insurance is a requirement for every vehicle owner, and the market is saturated with a wide array of options. With such a variety of insurance companies to choose from, it can be challenging to decide which one offers the best coverage at an affordable price. Fortunately, there are several key factors to consider when choosing the best auto insurance policy for you. In this article, we will cover the five most important factors to help you make an informed decision, and we’ll also highlight some of the leading auto insurance providers such as State Farm, GEICO, and Allstate.

1. Compare Prices and Coverage

The first step in choosing the best auto insurance is to compare prices and coverage from different companies. Leading insurers such as State Farm, GEICO, and Allstate offer different policy types and coverage levels. It’s crucial to find an insurance plan that balances affordability with comprehensive coverage.

Insurance companies offer a variety of policies, ranging from basic liability insurance to more extensive coverage that includes collision and comprehensive protection. For example, GEICO is known for offering affordable basic policies, while State Farm and Allstate offer a range of options that provide enhanced coverage, including uninsured motorist protection, personal injury protection, and comprehensive damage coverage.

In addition to comparing the types of coverage, it's important to shop around to find the most competitive rates. You can use online comparison tools to get quotes from multiple providers and see how they stack up against one another. By comparing both cost and coverage, you’ll ensure you get the best value for your money.

2. Look for Discounts

Many car insurance providers offer discounts that can significantly reduce your premiums. Discounts may be based on a number of factors, such as your driving history, your car model, and even the type of coverage you choose. State Farm and Allstate offer discounts for safe driving, while GEICO provides special deals for military personnel, students, and bundling multiple insurance policies.

Additionally, the US government has recently implemented a mandatory insurance reform for all car purchases. Under this reform, buyers are eligible for discounts of up to 30% on their insurance premiums. This is a huge benefit for consumers, especially those purchasing new vehicles. Many of the major auto insurance providers have adopted this new regulation, allowing customers to take advantage of the savings.

To ensure you get the best possible price, it's important to ask your provider about available discounts. You can also apply for government-sponsored discounts or take advantage of insurance bundles that combine auto insurance with other policies like home or renters insurance.

3. Consider Customer Service and Claims Process

Choosing an insurance company is not just about the price—it’s also about the customer experience. A company that provides excellent customer service and a smooth claims process is essential when you need help most. Reviews from other customers are a good way to assess the quality of service a company provides.

Allstate is well-regarded for its user-friendly mobile app that allows you to file claims, track the status of your policy, and make payments directly from your phone. State Farm and GEICO are also known for their easy-to-use online platforms and responsive customer service teams. Before committing to an insurance provider, be sure to check online reviews and ratings on platforms like Trustpilot and J.D. Power to see how the company handles customer service and claims.

It's important to note that an efficient and accessible claims process can make all the difference, especially in the event of an accident. Companies like GEICO offer 24/7 customer support, which can be extremely helpful if you need to file a claim outside of regular business hours.

4. State Requirements and Coverage Options

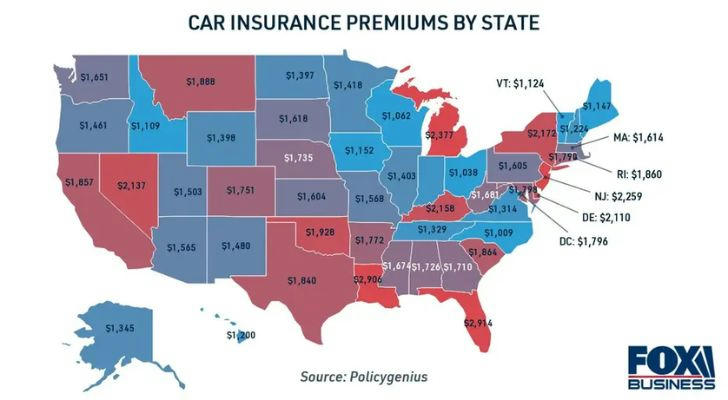

Each state in the US has its own minimum requirements for auto insurance. These requirements dictate the types and levels of coverage that are mandatory for drivers in each state. For example, in California, drivers are required to carry a certain level of liability insurance, while Florida has different regulations regarding uninsured motorist coverage.

Make sure that the policy you choose complies with the state requirements for where you live. However, just meeting the minimum requirements may not be enough—consider purchasing additional coverage for better protection. If you live in an area prone to severe weather or natural disasters, for example, you may want to opt for comprehensive coverage to protect your vehicle from environmental damage. Your insurance provider can help guide you in choosing the right level of coverage for your needs and location.

5. Look into the Company’s Reputation

The reputation of an insurance company plays a critical role in the decision-making process. A reputable company that has been in the business for many years is more likely to provide solid coverage and financial stability. It's essential to choose a provider with a strong financial standing, as this ensures they will be able to pay out claims when necessary.

State Farm and GEICO have built solid reputations for being reliable and financially stable companies. Allstate also has a strong reputation for excellent customer service and claims handling. You can use websites like Better Business Bureau (BBB) and Trustpilot to check the company’s track record, looking for customer satisfaction ratings, as well as any complaints or issues with claims settlements.

Conclusion

Choosing the right auto insurance company is crucial for both protecting your vehicle and securing peace of mind. By comparing prices and coverage, seeking out discounts, considering customer service, and ensuring the company’s reputation, you’ll be on the right track to finding the best insurance provider for your needs.

Additionally, with the recent US government mandate requiring all vehicle purchases to have mandatory insurance coverage with discounts of up to 30%, now is the ideal time to shop for an auto insurance policy that fits your needs and budget. Companies like State Farm, GEICO, and Allstate provide a variety of options to help you get the best deal possible.

Want to learn more about available auto insurance options and discounts? Visit this helpful link for more details on getting the best rates and coverage.